Causes, Costs and Consequences: The Economics of the American Civil War

by Roger Ransom

Economic factors played a large role in bringing on the Civil War and in determining who won it.

Writing sixty years after the end of the American Civil War, historians Charles and Mary Beard looked back and decided that the time had come “when the economist and lawyer, looking more calmly on the scene”, could discover “that at the bottom of the so-called Civil War, or the War between the States, was a social war, ending in the unquestioned establishment of a new power in the government.” The conflict, they insisted, was a “Second American Revolution” that transformed the United States into an industrial society. What became known as the “Hacker-Beard Thesis” was summarized a few years later by Louis Hacker in his book The Triumph of American Capitalism:

The American Civil War turned out to be a revolution indeed. But its striking achievement was the triumph of industrial capitalism. The industrial capitalist, through their political spokesmen, the Republicans, had succeeded in capturing the state and using it as an instrument to strengthen their economic position. … [T]he victory was made secure by the passage of tariff, banking, public-land, railroad, and contract labor legislation.[1]

Hacker and the Beards presented a dramatic historical narrative that tied the issues surrounding America’s great political crisis in the middle of the nineteenth century to the powerful dynamics behind the emergence of an industrial system dominated by large firms towards the end of the century. “The persuasiveness (if not the logic), the panoramic scope, as well as the iconoclastic nature of the thesis,” wrote Robert Sharkey in 1959, “recommended it to readers of history as well as historians.” Peter Novick pointed out that “no alternative conceptualization of the sweep of American history emerged in the interwar years”[2]

Despite the obvious appeal of this grand historical narrative, a growing number of historians were uncomfortable with some of the details surrounding the Hacker-Beard thesis. Historians studying economic growth in 19th century America found that the war had not spurred economic growth, and argued industrialization would have occurred without the war. The war was seen as an unfortunate interruption to the development of the American Economy that was of little interest to economic historians.[3]

Wars seldom make much “economic” sense. However, in the case of the Civil War, the “economics” of the war and its aftermath have proven to be more intriguing than most. The Beards may have been off the mark in claiming that the war accelerated industrial growth, but a strong case can be made for their claim that the rapid commercial and industrial growth in the Northern states before the war played a part in fanning the regional tensions between the industrial North and the rural South. Historian Richard Brown observed in his book on the modernization of America that “without attempting to prove that modernization ‘caused’ the Civil War, one may argue that it was very much the conflict of a modernizing society.”[4]

This essay focuses on the three major issues: the economics of slavery that were at the core of the antebellum disputes that led to the crisis of 1860, the economic factors that contributed to the North’s victory in the war, and the economic legacy of America’s most destructive war.

Slavery and the Economics of the Civil War

Slavery had been an uncomfortable fact of life in the United States since the founding of the republic. The constitution was carefully crafted to protect the right to own slaves. Most people at that time were willing to accept the fact that the 700,000 enslaved African Americans living in the United States would be treated as property, not people. Almost all of this slave property was owned by people in the Southern states, where the chattel labor formed the backbone of a plantation economy that produced tobacco, rice, sugar, and a little bit of cotton. Many Northerners had a distinct dislike of slavery; however they assumed that the Northwest Ordinance of 1787, which prohibited slavery north of the Ohio River, would effectively keep the slave population in the South. The United States in 1790 was an economy struggling to survive in a mercantilist world. As Douglass North noted, “the relative scarcity of labor and capital was not likely to be ameliorated in the near future, nor did prospects for expanding markets appear imminent.”[5]

Three developments dramatically changed this scenario. First was the invention of the cotton gin by Eli Whitney in 1790, which greatly reduced the amount of labor required to “clean” short staple cotton. Second was the emergence of a cotton textile industry in Great Britain, which created a demand for American cotton. Finally, the acquisition of the Louisiana Purchase in 1803 significantly expanded the territory suitable for plantation agriculture. Taken together, these events transformed the United States from the struggling economy of 1790 into a bustling exporter of cotton by the end of the war of 1812.

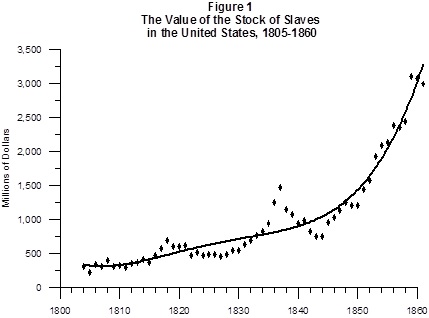

It is difficult to exaggerate the effect these economic changes had on the political and social development of the United States. Whatever political and moral objections Americans might have to slavery, they all had a huge economic stake in South’s “peculiar institution”. In the eleven states of the Confederacy, where the slave labor force was the backbone of the plantation economy, one out of three individuals was an economic asset in some slave owner’s portfolio. The $3 billion that Southerners invested in slaves accounted for somewhere between 12% and 15% of all real wealth in the entire United States. Figure 1 charts the increasing value of the stock of slaves from 1805 to 1860. Far from dying out, slavery was expanding at an increasing rate right up to the eve of the Civil War.

The economic problem of slavery was difficult for politicians to deal with because it proved to be very compatible with the capitalistic marketplace in the United States. Most observers of slavery failed to appreciate that the return from an investment in slaves included not only the return from the slave’s labor, but also the value of any children born to female slaves. In 1958 Alfred Chandler and John Meyer developed an “asset-pricing” model of slavery that demonstrated that the value of slave children made slavery profitable throughout the South. Southern planters, they pointed out, not only grew cotton, rice and tobacco; they also grew slaves. Subsequent research has convincingly supported Conrad-Meyer’s argument that slavery was profitable. Slavery was thefoundation the Southern economy. The staple crops grown by slaves in the South were a pivotal part of the rapid economic growth of the entire United States in the antebellum period. Cotton exports accounted for two-thirds of the value of American exports, and one-fourth of the income accruing to all whites in the slave states could be attributed to slave labor in 1859.[6]

All this brings us back to the arguments surrounding the Hacker-Beard Thesis. While Southern farmers continued to plant more cotton, acquire more slaves and settle more land, things in the North were changing. Whether it is called it a “market revolution,” an “industrial revolution,” or “a take-off into sustained growth;” the inescapable fact was that a process of economic and social change was sweeping across the Northern states. Industries expanded; canals and railroads stretched from the Atlantic to the Mississippi; interregional trade flows expanded at a prodigious rate, and immigrants flooded into the cities of the North. The Southern vision of political economy was shaped by an economic system that was basically static in nature. Southerners felt threatened by what they saw as the “Yankee Leviathan”. As historian James McPherson notes,

When secessionists protested in 1861 that they were acting to preserve traditional rights and values they were correct. … The ascension to power of the Republican Party, with its ideology of competitive, egalitarian, free-labor capitalism, was a signal to the South that the Northern majority had turned irrevocably towards this frightening, revolutionary future.[7]

The Civil War was in reality two revolutions. Southerners launched their revolution—more accurately a counterrevolution—in an effort to break free from political union with the North. Northerners fought to defend the revolutionary process that had transformed their society into a market industrial society.

Arguments over the “right” to own slave property increasingly became a question of social and economic change. In December 1858 Senator William Seward of New York, told his colleagues that the collision of interests between North and South was not “the work of interested or fanatical agitators;” it was, he explained, “an irrepressible conflict between opposing and enduring forces, and it means that the United States must and will sooner or later, become entirely a slaveholding nation or entirely a free-labor nation,” Well-meaning men in congress and elsewhere could debate at length the issues of political economy between North and South, but when push came to shove the problem of what to do with 4 million slaves worth three billion dollars was a deal breaker. As Thomas Jefferson observed after the debates surrounding the Compromise of 1820, “we have the wolf by the ear, and we can neither hold him, nor safely let him go. Justice is in one scale, and self-preservation in the other.” The inability of lawmakers to deal with economics of slavery proved to be the undoing of the American Union in the fall of 1860. “The realignment of the 1850s,” wrote James Huston, “was about slavery, the slave power, and the protection of a free labor village society … Republicans changed the agenda of the country by altering the property rights in people. That is not to say that either side wanted a war. The problem was that neither side was willing to back down from the showdown when it came. On April 12, 1861 Confederate batteries opened fire on Fort Sumter in Charleston Harbor.[8]

The Civil War had begun.

The Economic Costs of the War

In addition to preserving the Union, the Northern victory eliminated the right to own slaves in the United States. These outcomes were achieved at an enormous cost. Three million men – or about 10% of the population of the United States in 1860 and nearly half of all men aged 15-30 – fought in either the Union or Confederate Army. For many years the accepted estimate of deaths was 624,000 men. This figure was based the work of Thomas Livermore, a retired Union officer who studied battle reports and lists of units serving in the war. A more recent estimate of Civil War deaths constructed from census data by J. David Hacker has produced an estimate of around 750,000 deaths. Why so many more? Hacker notes that existing estimates seriously undercounted many war-related deaths. The census data captures deaths of men who died shortly after the war from injuries sustained during the war. Neither method is perfect; however, both suggest a level of mortality among Civil War soldiers that exceeds anything approached in previous or subsequent American Wars. Their deaths produced a legacy of sorrow and bitterness that lingered for generations after Appomattox.[9]

The most comprehensive estimates of the economic costs of the war are those developed by Claudia Goldin and Frank Lewis. Their estimates suggest that government expenditures by both governments totaled $3.3 billion; the estimated “value” of human capital lost because of deaths in the war was $2.2 billion; and the Physical destruction was just under $1.5 billion. The total bill for the war came to $7 billion – or roughly two full years of GDP in 1860. What stands out from these numbers is not only the absolute magnitude of the costs, but also the disparity in the burden that these costs represented to the people in the North and the South. On a per capita basis, the costs to the Northern population were about $139 – or just slightly less than a year’s per capita GDP the income of the United States economy in 1860. The per capita burden on Southerners was almost three times that amount.[10]

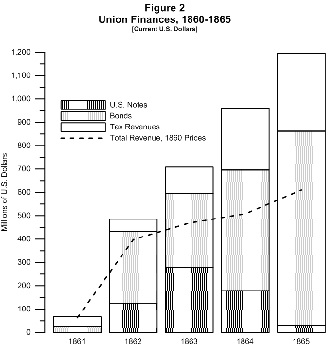

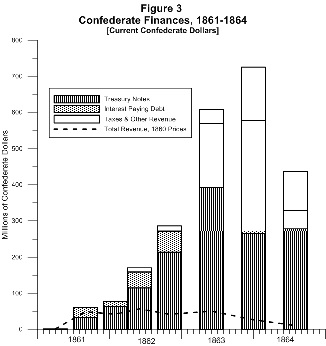

The Union had a clear advantage in the “economics” of this war. It not only had a population roughly three times the free white population of the Confederacy, it also had the advantage of larger and far more sophisticated market institutions with which to organize its war effort. However, neither side was prepared to raise the revenues required to cover the soaring costs of the war, and it took the better part of a year for each side to “mobilize”. By the spring of 1862 it was apparent that both would have to resort to a combination of taxation, selling bonds (if they could find anyone willing to buy them), and the issuance of various forms of paper money. Figures 2 and 3 present estimates of the revenues collected by each side to “pay” for the war.

The figures present estimates for revenues raised through taxes, revenues raised by issuing treasury notes as fiat currency, i.e. not backed by or convertible into gold but only backed by silver, and revenues from interest-bearing debt that was sold to private buyers. The dotted line indicates the total revenues adjusted for inflation.[11]

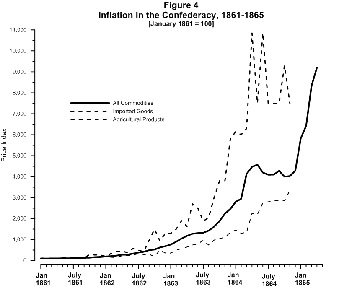

The first thing to note is the extent to which both sides were forced to rely on deficit finance to pay for the war. The Union did succeed in increasing tax revenues by enacting a higher tariff, and higher excise taxes, and passing a tax on incomes above $10,000 per year. Even so, tax revenues accounted for only about a quarter of all federal revenues during the war. Confederates were much less successful in their efforts to obtain tax revenues. They inherited a tax system where tariffs had accounted for three-fourths or more of the federal government’s revenues each year. That tax base quickly eroded away as the effectiveness of the Union blockade increased. Over the course of the war, taxes and assorted revenues accounted for less than 10% of total revenue. With limited possibilities of selling bonds, the Confederates were forced to rely on the printing of money as the primary means of paying their bills. The result of that policy was an inflationary spiral that eventually reached a point where prices were more than 9,000 times their level at the beginning of the war. Inflation played a role in the financial struggles of both governments. In the North prices reached a level in 1865 that was roughly twice the level in 1860. Despite the increase in prices, revenues collected by the Union government rose steadily throughout the war. Inflation imposed a significant “tax” on Northern consumers, but it did not seriously affect the war effort.

The same cannot be said of the Confederate mobilization efforts. Figure 4 charts the overall rise in commodity prices; it also portrays the impact of the blockade on imported goods—a situation that weighed heavily on the minds of consumers used to getting a variety of their consumption items from abroad. Finally, we can see that the level of the agricultural prices—which comprised the principal source of income for the rural South—lagged behind the costs of other goods. These developments not only drained the morale of Confederates on the home front, they also crippled the Confederate war effort Measured in 1861 prices, the flow of funds to the Richmond government reached their peak by early 1862, remained fairly stable through the middle of 1863, and then declined steadily thereafter. For all intents and purposes, the Confederacy had been reduced to a barter economy by the time Lee surrendered his army at Appomattox.

While the mobilization efforts of the South gradually bankrupted the Southern war effort, the Union was able to develop models of business operations that would influence business practices in the coming decades. In his study of the “business” of the Civil War, Mark Wilson observes that “for better or for worse the model of military organization and administration … did influence the modern American imagination to an extent that is rarely recognized.” This was not only true of the production of goods and services; it also pertained to the improvements that allowed the bond markets to absorb $2.3 billion in federal debt issued during the war.[12]

The Economic Consequences of the War

In a civil war, what is a “cost” to one side may sometimes be regarded as a “gain” to the other. An obvious example of was the emancipation of 4.5 million slaves. Goldin and Lewis estimate that freeing the slaves resulted in an economic loss of almost 2 billion dollars to southern planters. This loss was a result of the decline in cotton production associated with the end of slavery and the breakup of the plantation system. Goldin and Lewis count this as a “cost” of the war. Richard Sutch and I point out that this “cost” can also be considered a measure of the benefits to free black Southerners freed from the exploitation of slavery. The same logic could be applied to the capital losses suffered by slaveholders (including some in the four states that did not secede from the union), which totaled more than $4 billion. Slaveholders saw this decline in their net worth as a very real burden from outcome of the war; Northerners regarded it as a transfer payment that was justified as one of the principal accomplishments of the war.[13]

The war had done away with slavery, but in the process it destroyed the southern banking system and eliminated a major part of Southern antebellum capital stock. The sudden disappearance of both capital and labor meant that the agricultural economy of the South had to be completely restructured. Within a few years the plantation agriculture of the antebellum South had all but disappeared. What emerged in its place was a set of arrangements where landowners leased land to freedmen under a new form of tenure called “sharecropping” where the laborers agreed to work the land in return for a fraction of the crop they produced. Left to their own devices, neither the “cropper” nor the landlord would have chosen the sharecropping arrangement. Freedmen would have preferred to rent land for cash so they could work their own farm; landlords would have preferred to hire the labor for cash and retain control of their plantation. But there was no cash available in the South in 1865-66 and the crops had to be planted. Sharecropping had the advantage that it was an arrangement that required little or no cash, and the cotton crop served as collateral for advancing credit to buy essentials at the local store.

Unfortunately, sharecropping also had the disadvantage of allowing the landowners and the merchants to exploit their tenants by “locking” them in to the production of cotton and forcing them to purchase food rather than to grow it. The result was that crop output in the South fell dramatically at the end of the war, and had not yet recovered its antebellum level by 1879. The loss of output was particularly hard on white Southerners, whose per capita income fell from $125 in 1857, to just over $80 in 1859-60 dollars. Freedmen were better off than they had been as slaves, but there was little prospect for them to improve their economic position. Denied the opportunity to own their own land, and confronted with the inefficiency imposed by the share-cropping, blacks faced a grim future. Over the last quarter of the nineteenth century, gross crop output in the South rose by about one percent per year at a time when the GNP of United States (including the South) was rising at twice that rate. By the end of the century, Southern per capita income had fallen to roughly two-thirds the national level, and the South was locked in a cycle of poverty that lasted well into the twentieth century. How much of this failure was due to the war remains open to debate. What is clear is that the hopes of Southerners of both races, for a “New South” that might emerge from the destruction of war after 1865, were realized.[14]

While the South struggled with the agony of defeat, the North enjoyed the fruits of victory. The demise of the slave power and its antebellum political alignments not only strengthened the federal government it shifted political power into the hands of the victorious Republicans. “From 1861 to 1877,” writes Richard Bensel, “the American state and the Republican Party was essentially the same thing; the federal government was simply the vehicle of common interests in economic development associated with northern finance, industry, and free soil agriculture.” In the spring of 1862 congress approved a series of laws that changed the economic landscape of the United States. The National Banking Act established a system of banks that were chartered by the federal government and issued a single currency. The Homestead Act gave settlers allotments of 160 acres of free land in the West. More than 1 million parcels of land were eventually distributed under the terms of this act. The Pacific Railway Act facilitated construction of a railway by giving grants of federal land to build the first transcontinental railroad. By 1900 there were five transcontinental railways and 200,000 miles of railroads in the United States. The Morrill Land Grant Colleges Act established federal land grants that provided the foundation for one of the most impressive systems of public education in the world. The impact of all four of these acts is still evident 150 years later. Additional legislative and judicial actions followed over the next two decades.[15]

The Beards were right in their claim that the Civil War was part of a “revolution” that already well underway in the Northern states when war broke out. The war itself was an interruption, of that growth pattern but the changes it brought about helped to create one of the most rapid periods of industrial growth in American history. What the Beards did not fully grasp was the economic significance of the Thirteenth amendment to the Constitution which was approved by the House of Representatives on January 31, 1865. The stalemate over slavery that had produced the political crisis of 1861 was at its root an economic problem. In a market society committed to the principle of private property, the enormous influence of the huge investment in slave property was able to effective block any perceived political actions that would place limits on slave property. With a stroke of a pen the abolition of slavery simply eliminated that obstacle to political reform. Unfortunately, the economics of slavery meant that the only way to resolve the disputes over slavery and keep the union together was to wage a bloody war.

Economic factors not only played a large role in bringing about the war, they also had a huge role in determining who won the war. Southerners gambled that Southern spirit and military élan could overcome the wealth and size of the North. They were wrong. In a speech delivered after the war, Robert E. Lee’s former commander Jubal Early remarked on the consequences of that gamble.

General Lee had not been conquered in battle, but surrendered because he had no longer an army with which to give battle. What he surrendered was the skeleton, the mere ghost of the Army of Northern Virginia, which had been gradually worn down by the combined agencies of numbers, steam-power, railroads, mechanism, and all the resources of physical science. … [Four years of fighting] had finally produced that exhaustion of our army and resources, and that accumulation of numbers on the other side, which wrought the final disaster.[16]

General Early had discovered to his dismay that this was a new form of warfare where economics extended far beyond the marketplace onto the battlefields of the war. It is in this sense more than any other that the American Civil War has been termed the first “modern” war.

Statistical Appendices:

Figure 1: The total value of slaves is taken from Table 3 in Roger L Ransom and Richard Sutch, "Capitalists Without Capital: The Burden of Slavery and the Impact of Emancipation." Agricultural History 62, no. 3 (Summer 1988), 133-160.

Figure 2: The data for United States government revenues are taken from Richard Sutch and Susan Carter, Historical Statistics of the United States, Earliest Times to the Present: Millennial Edition. 5 vols. (New York: Cambridge University Press, 2006) Series Ea-584 (Total Revenue), Ea-652 (Notes) and Ea-587 (Interest Bearing Debt). The estimates for the real value of total revenue was calculated using the David Solar Index of Prices; in ibid, vol. 3, Series Cc-2.

Figure 3: The data for sources of Confederate States government revenues are calculated from ibid., vol. 5. Series Eh-194 through Eh209. The data in this table were not reported on an annual basis. The graph in Figure 3 plots the midpoint of the eight periods reporting between April 1865 and October 1864 for each revenue source. The estimate for the real value of total revenue was calculated using the price index for all goods in Table 4 below. The monthly price data for each variable were averaged over each time period reporting government revenues.

Figure 4: The prices reported for the Confederacy are taken from ibid., vol. 5, Series Eh-166-Eh-177.

Figure 5 The figures are taken from Roger L Ransom and Richard Sutch, "Growth and Welfare in the American South in the Nineteenth Century," in Gary M Walton and James F. Shepherd, eds., 1981. Market Institutions and Economic Progress in the New South, 1865-1900: Essays Stimulated by One Kind of Freedom (New York, Academic Press, 1981), 145.

- [1] Charles Beard and Mary Beard, The Rise of American Civilization, 2 vols. (New York: Macmillan, 1927), 1:53; Louis Hacker, The Triumph of American Capitalism: The Development of Forces in American History to the End of the Nineteenth Century (New York: Columbia University Press, 1940), 373.

- [2] Robert P. Sharkey, Money, Class, and Party: An Economic Study of Civil War and Reconstruction (Baltimore: Johns Hopkins University Press, 1959), 301; Peter Novick, That Noble Dream: The "Objectivity Question" and the American Historical Profession1988 (New York: Cambridge University Press, 1988), 240.

- [3] Thomas Cochran touched off a vigorous debate with his article "Did the Civil War Retard Industrialization?," Mississippi Valley Historical Review 48, (September 1961):197-210. For a summary of the debate see Stanley L. Engerman, "The Economic Impact of the Civil War," Explorations in Entrepreneurial History 2nd Series, no. 3, no. 3 (Spring 1966):176-99; Ross Robertson emphasized this aversion to war in his 1955 textbook on American History. “Except for those with a particular interest in the economics of war,” he wrote, “the four year period of conflict [1861-65] has had little attraction for economic historians” Ross M. Robertson, History of the American Economy, 2nd ed. (New York: Harcourt Brace and World, 1955), 247.

- [4] Richard D. Brown, Modernization: The Transformation of American Life, 1600-1865 (New York: Hill and Wang, 1976), 161.

- [5] Douglass C. North, The Economic Growth of the United States, 1790-1860 (Englewood Cliffs, NJ: Prentice Hall, 1961), 23.

- [6] Alfred H. Conrad and John R. Meyer, "The Economics of Slavery in the Ante Bellum South," Journal of Political Economy 66, no. 2 (April 1958): 95-130; There is an extensive literature on the economics of slavery and the growth of the antebellum South. For a quick overview, see Jeremy Atack and Peter Passell, chaps. 11-12 in A New View of American History From Colonial Times to 1940, 2nd. ed. (New York: W.W. Norton, 1994), Roger L. Ransom, chap. 3 in Conflict and Compromise: The Political Economy of Slavery, Emancipation, and the American Civil War (New York: Cambridge University Press, 1989), Gavin Wright, Slavery and American Economic Development, (Walter Lynwood Fleming Lectures in Southern History) (Baton Rouge: Louisiana State University Press, 2006); and Gerald Gunderson, "The Origin of the American Civil War," Journal of Economic History 34, no. 4 (December 1974): 922. Income estimates suggest that per capita income in the South was roughly equal to that of the North. See Richard A. Easterlin, "Regional Income Trends, 1840-1950," in American Economic History, Seymour E. Harris, ed., (New York: McGraw Hill, 1961).

- [7] This section draws heavily on the research that Richard Sutch and Roger Ransom present in "Conflicting Visions: The American Civil War as a Revolutionary Conflict," Research in Economic History 20 (2001):249-301. Other works that deal with the political economy of the 1850s include Richard F. Bensel, Yankee Leviathan: The Origins of Central State Authority in America, 1859-1877 (New York: Cambridge University Press, 1990), Charles Sellers, The Market Revolution: Jacksonian America, 1815-1846 (Oxford: Oxford University Press, 1991), and Marc Egnal, Clash of Extremes: The Economic Origins of the Civil War (New York: Hill and Wang, 2009); James M. McPherson, "Antebellum Southern Exceptionalism: A New Look at an Old Question," Civil War History 29, no.3 (September 1983): 243.

- [8] Quoted in Eric Foner, Free Soil, Free Men and Free Labor: The Ideology of the Republican Party Before the Civil War (New York: Oxford University Press, 1970). 69-70; Paul Leister Ford, ed., The Writings of Thomas Jefferson, 12 vols. (New York: G.P. Putnam's and Sons, 1893), 12:159; James Huston, Calculating the Value of the Union: Slavery, Property Rights, and the Economic Origins of the Civil War (Chapel Hill: University of North Carolina Press, 2003), 234.

- [9] Thomas L. Livermore, Numbers and Losses in the Civil War in America 1861-1865 (Boston & New York: Houghton, Mifflin, 1901). Livermore presented estimates of the number of men “killed, wounded, and missing” for selected battles of the war. His estimates of battle casualties have held up well for more than a century, but at best they are still only educated guesses for the number of wartime deaths. For a further discussion of measuring battle casualties in the Civil War see Roger L. Ransom, The Confederate States of America: What Might Have Been (New York: W.W. Norton, 2005), Appendix 1; J. David Hacker, "A Census Based Count the Civil War Dead," Civil War History 57, no.4 (2011): 307-48. Hacker uses data from census schedules of the 1860 and 1870 censuses to estimate what he calls the “excess deaths” during the Civil War decade. His results produce a range of possibilities with a low of about 700,000 deaths and a maximum of 800,000 deaths. I have taken the midpoint of this range as my revised estimate. Unfortunately, Hacker’s methodology does not allow us to allocate those deaths between the Union and the Confederacy.

- [10] Claudia Goldin and Frank Lewis, "The Economic Costs of the American Civil War: Estimates and Implications," Journal of Economic History 35, no.2 (June 1975): 299-326. While most scholars accept the Goldin-Lewis estimates of “direct: costs” of the war, this article sparked a spirited debate about the “indirect” or longer-term costs of the war. See Roger L. Ransom, "The Economic Consequences of the American Civil War," in The Political Economy of War and Peace, Murray Wolfson, ed., (Norwell, MA: Kluwer Academic Publishers, 1998); Peter Temin, "The Post-Bellum Recovery of the South and the Cost of the Civil War.," Journal of Economic History 36, no. 4 (December 1976): 898-907. and Claudia Goldin and Frank Lewis, "The Post-Bellum Recovery of the South and the Cost of the Civil War: Comment," Journal of Economic History 38, no.2 June (1978): 487-92.

- [11] The sources for these figures are explained in the statistical notes at the end of the essay. The data for the Confederacy was reported at uneven intervals from April 1861 through October 1864.

- [12] Mark Wilson, The Busines of Civil War: Military Mobilization and the State, 1861-1865 (Baltimore: The Johns Hopkins Press, 2006), 224-5.

- [13] A major part of the decline in cotton production reflected the reduction in labor force participation created when free blacks refused to work the long hours they had been forced to work as slaves. See Roger L. Ransom and Richard Sutch, chapter 5 in One Kind of Freedom: The Economic Consequences of Emancipation, 2nd ed. (New York: Cambridge University Press, 2001).

- [14] For more on the transformation of Southern agriculture see ibid., chapters 8 and 9 and the epilogue; The data on crop output and income are from "Growth and Welfare in the American South in the Nineteenth Century," Explorations in Economic History 16, no. 2 (April 1979)487-92.

- [15] Bensel, Yankee Leviathan, 3-4.

- [16] Quoted in Gary Gallagher, The Confederate War: How Popular Will, Nationalism, and Military Strategy Could Not Stave Off Defeat (Boston: Harvard University Press, 1997). 168-9.

If you can read only one book:

Ransom, Roger L. Conflict and Compromise: The Political Economy of Slavery, Emancipation, and the American Civil War. New York: Cambridge University Press, 1989.

Books:

Conrad, Alfred H., and John R. Meyerbook "The Economics of Slavery in the Ante Bellum South," Journal of Political Economy 66, no. 2 (April 1958): 95-130.

Egnal, Marc. Clash of Extremes: The Economic Origins of the Civil War. New York: Hill and Wang, 2009.

Engerman, Stanley L. "The Economic Impact of the Civil War," Explorations in Entrepreneurial History 2nd Series, no. 3, no. 3 (Spring 1966):176-99.

Goldin, Claudia, and Frank Lewis. Claudia Goldin and Frank Lewis, "The Economic Costs of the American Civil War: Estimates and Implications," Journal of Economic History 35, no.2 (June 1975): 299-326.

Huston, James. Calculating the Value of the Union: Slavery, Property Rights, and the Economic Origins of the Civil War. Chapel Hill: University of North Carolina Press, 2003.

McPherson, James M. "Antebellum Southern Exceptionalism: A New Look at an Old Question," Civil War History 29, no.3 (September 1983): 230-44.

Ransom, Roger L. The Confederate States of America: What Might Have Been. New York: W.W. Norton, 2005.

———. "The Economics of the Civil War." in Eh.Net Encyclopedia, http://eh.net/encyclopedia

———. "The Economic Consequences of the American Civil War," in The Political Economy of War and Peace, Murray Wolfson, ed., (Norwell, MA: Kluwer Academic Publishers, 1998).

———. Conflict and Compromise: The Political Economy of Slavery, Emancipation, and the American Civil War. New York: Cambridge University Press, 1989.

Ransom, Roger L., and Richard Sutch. "Conflicting Visions: The American Civil War as a Revolutionary Conflict," Research in Economic History 20 (2001).

———. "Growth and Welfare in the American South in the Nineteenth Century," Explorations in Economic History 16, no. 2 (April 1979): 487-92.

Wilson, Mark. The Busines of Civil War: Military Mobilization and the State, 1861-1865. Baltimore: The Johns Hopkins Press, 2006.

Wright, Gavin. Slavery and American Economic Development. Baton Rouge: Louisiana State University Press, 2006.

Organizations:

No organizations listed.

Web Resources:

Eh.Net’s Encyclopedia of Economic History contains several entries relating to antebellum and Civil War economics.

Other Sources:

No other sources listed.